Despite the numerous and often digitalization-driven criticalities that manufacturers and market players are facing, the pulp and paper global landscape still appears lively and most of all able to build upon the opportunities that some steady-growing sectors can today provide.

The Paris-headquartered consultancy and financial risk-monitoring company Euler Hermes has recently released its 2017 outlook on the pulp and paper industry worldwide. The good news, according to analysts, is that «the paper’s era has not come to an end yet» despite the troubles it has been undergoing over the last years. In fact, it is Euler Hermes’s opinion that this year the global gross output of pulp and paper is poised to increase by a 1.4% rate. This growth is expected to be driven by «a surprising resilience of mass retailing and a rising demand for e-commerce packaging» especially. Observers estimated that the value of the entire sector amounts today to 1,190 billion dollars and assigned it a moderately high risk rating. The US, Japan and China are considered as the key players in the international arena. The United States are number one importers and second in terms of production; Japan is ranked number three among producers while China is the best performing manufacturing country. The pulp and paper industry can rely on a series of points of strength as the growing structural need for packaging, boosted by the increase of the aforementioned e-commerce and retail activities; as well as by a recovery of the manufacturing industry in general. The so-called emerging markets display a rocketing demand for hygienic products, in line with the development of their middle-class, and this is also something that producers can benefit from. Of course, weaknesses deserve to be pointed out too, like the high sensitivity to pulp prices and their fluctuations; the «low level of cash-flow generation» that puts at risk «the ability to face restructuration costs». And finally, competition is an additional thorn in the side, given that plastics prove now most competitive, against paperboard, «in the packaging outlet», due to falling oil and gas prices. While on the one hand newsprint and printing papers are facing a harsh time, caused by digitalization; on the other hand experts forecasted that tissue papers are likely to experience further success, representing the highest-added value paper industry.

The European scenario

Last February, Cepi, the Confederation of European Paper Industries, published its preliminary statistics for the year 2016, comparing regional data with the evidences provided from other global paper-producing areas. According to the Association, last year paper and board production in Europe showed a slight decline from 2015, recording a -0.1% decrease and a 91 million tonnes output. It is important to notice that machine closures were there too but Cepi considered that they were «compensated by new capacities or upgrading of existing ones». At the same time, European players noticed that paper and board imports into Europe have increased by a 6% rate between 2015 and 2016, while overall consumption in the Cepi nations is also on the rise: +1% in the period. Taking a look at the worldwide scenario, the Confederation of European Paper Industries stated that the US and Canadian production might record a slowdown in 2016, with an expected -1% and -1.8% fall of their annual output. South Korean production should instead experience a modest progress (+0.5%) while more interesting results are forecasted to come from Russia-CIS (+3.8%), India (+2.9%) and China, with a +2.9 percentage points improvement. Furthermore, preliminary data foresee that «world paper and board production will be up by 0.8% in 2016» to «410 million tonnes». Sanitary and household-oriented manufacturers posted satisfactory results, given their +1.8% increase in volumes, that allowed them to account, late last year, for 8.1% of total production. As it was largely predictable, both printing and publishing activities are still stuck in a most critical moment: in fact, graphic grades fell worldwide by a 3.7% rate, according to Cepi, while the output of newsprint might also see a decline, around 6.4 percentage points.

Investing in a sustainable future

An interesting and detailed analysis of the Italian paper industry in the second half of 2016 was carried out early this year by Assocarta, the association that represents the national providers of board and paper together with paper-related machinery or technology manufacturers. As for the domestic market, increasing revenues characterized 38% of the latter in the third quarter of the year, while 45% reported a growth in orders. 50% of producers saw their overseas business on the rise and 42% of the interviewed managers would forecast a further increase in revenue by the end of the year. 71% of the Italian market is made up of paper and board producers that, according to Assocarta, recorded a poor performance on the domestic front but managed to gain encouraging results on the export side. Between July and September, 2016, 46% of local companies reported falling values and only 14% said it was undergoing a moment of growth. 53% of firms said their overseas sales were rising and 56% had received a larger amount of orders than in the same period of 2015. Two years ago, the Italian paper sector generated an 8.8 million tonnes output, imported 5 tonnes of materials and its exports were as high as 3.9 million tonnes. Apparent consumption, in the country, was estimated around 9.9 million tonnes. Overall revenues amounted to 6.9 billion euros, import value was 3,5 billion euros and exports, finally, were slightly less than 4 billion euros. In partnership with Cepi, Assocarta takes part today in the European initiative Roadmap 2050 that aims to define the investments needed to reduce carbon emissions by 80% in the next three decades, while at the same time ensuring a 50% increase in margins. This same project planned a 44 billion euros budget (40% more than the current allocation) in order to turn the European manufacturing sector into a low-carbon bio-economy by the end of 2050. But as Cepi general manager Sylvain Lhote stated, the paper industry has invested 15 billion euros in Europe since 2011, aiming to make its processes more sustainable, and it is now requested to strengthen its commitment by developing new low carbon, green products.

Mature markets vs. emerging countries

Late last year the United Nations Economic Commission for Europe (Ece or Unece) also released a complete report about the global industry of pulp and paper and its recent dynamics. In the Ece region graphic paper capacity fell by 1.7 million in 2015 and the Commission forecasted that it would suffer a further 1.1 million tonnes decline in 2016. Globally, the United Nations considered that a capacity of 4 million tonnes was «indefinitely or permanently removed from production in 2015», presuming «a further drop of 2.7 million tonnes» would take place the following year. The report underlined that «there is an ever pressing need to remove inefficient capacity in key markets to further improve the performance of the industry globally». Present criticalities are well depicted by figures that describe how the North American newsprint capacity fell to 5 million tonnes early in 2016, «down by 1.8 million tonnes from 2014». Unece also turned to consider the worldwide pulp market, stating that its overall production capacity is increasing constantly outside Europe. For example, a bleached eucalyptus kraft line with a 1.4 million tonnes potential output was opened two years ago in Brazil, immediately followed in 2016 by a 1.5 million tonnes bleached eucalyptus and softwood kraft plant. Indonesia represents another most interesting success case. At the Pulp and Paper Week that was staged in London nearly one year ago, corporate sources reported that in the country more than one million hectares of land were allocated for pulp and paper-related projects and 4.9 million licenses were given to pulp and paper producers. Further initiatives were planned, such as the opening of a single mill with two hardwood kraft pulp lines, scheduled in late 2016, with a 2.8 million tonnes capacity.

Integration strategies

These data help us mark the difference between the most dynamic and lively emerging markets and the more mature North-Western scenarios. Analysts at Ece observed in fact that «in such mature markets as Europe, Japan and North America, market pulp mill closures, integration into tissue and towel operations and conversions removed 2.1 million tonnes of market pulp capacity in 2015, and another 602,000 tonnes of integrated pulp capacity was permanently or indefinitely removed». The process of delocalization was also responsible for these changes, since «the expansion of wood pulp production between 2011 and 2016 was concentrated in hardwood grades and in low cost countries outside the Ece region». This does not mean, however, that the Ece business remained flat. In fact, the Commission pointed out that «a series of investments in the Ece region in softwood kraft pulp production saw capacity grow by almost 500,000 tonnes in 2015 and by another 1.3 million tonnes in 2016, in contrast to 2013-2014, when global softwood kraft capacity» was rather stagnant. Despite their undisputed role of market leaders, the United States are facing a number of difficulties too, since the Unece study recalled that a significant part of the US production capacity was permanently shut in recent years and that both in Europe and in the US some mills «swung production to softwood kraft grades in order to take advantage of higher margins». This also resulted in a slowdown of wood pulp production in Europe, since 2016.

The resilience of fibre

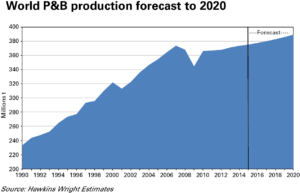

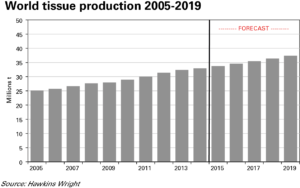

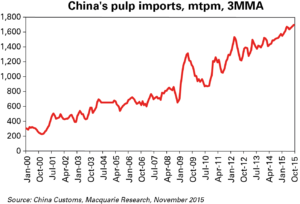

Estimates presented at the Hawkins Wright Symposium in London, last year, were only updated to 2015 but managed to offer in any case a reliable picture of the global paper and pulp market. For instance, it was noticed that printing and writing paper shipments from the so-called mature markets experienced a dramatic decline over the last decade, falling from the 20 million tonnes recorded in the first quarter of 2004 to the nearly 13 million tonnes delivered in the first quarter of 2015. At the same time, paper and board production worldwide saw an impressive growth, climbing from about 230 million tonnes in 1990 up to 375 million tonnes in 2015, with the perspective to reach the amount of 390 million tonnes at the end of this decade. As for fibre consumption, speakers pointed out that «market pulp demand proved remarkably resilient». While the performance of integrated pulp showed rather flat over the decades, and market pulp has been growing at a very slow pace since the early Nineties, recycled fibre consumption has been rocketing ever since, growing from an overall amount of nearly 100 million tonnes to more than 200 million tonnes in 2014. The reason for this performance, according to specialists, lies in the fact that the tissue demand is growing across all major regions, and «it is mostly non-integrated». Businesses are undergoing a series of definitional changes and corporate restructures, while paper production is decreasing in mature markets and still performing very well in the emerging economies. One of the major subjects of interest at the Hawkins Wright Symposium was represented by the behaviour of Chinese demand. Among the numerous challenges that the People’s Republic is to face speakers included the weakness of the export sector, negatively impacting the packaging industry. Paper-related businesses also have to take the real estate sluggish performance into account, that heavily hit the decorative paper segment. As witnessed in other countries and regions, tissue consumption is on the rise, although experts at the Hawkins Wright Symposium warned that this business is threatened by risks of oversupply. But furthermore, as researchers explained, «the lack of certification, currency strength and anti-dumping duties and measures all hinder the ability to export the surplus capacity».

The Chinese taste for tissue

While dealing with the decline of industrial investments, China still represents something as a promised land for paper manufacturers. Figures showed that pulp and paper imports were up to 1.3 million tonnes in the first nine months of 2015 and this trend is largely influenced by the growing demand for tissue as well as by the newly added, aforementioned production capacities. Market analysts are confident that the country will shift to a higher quality production in the short-medium time, and also that «in the longer term, China’s shift to consumerism will support paper and board demand growth, and continued fibre demand». Bleached chemical pulp has been one of the steadiest-growing commodities in China over the last decade and in the fourth quarter of 2015 its demand was still rising. Tissue production is not growing in the People’s Republic alone, given that Hawkins Wright forecasted that its overall amount will reach the peak of 37 million tonnes at least, globally, within two or three years, compared to the 25 million tonnes that estimates recorded only twelve years ago. Assuming the tissue market will continue its rally, a major issue for producers could be represented by surging operational and raw materials-related costs. Observers at the London Symposium noted in fact that since early 2012 the price of sorted office waste paper (Sop) have been rising faster and more significantly than those of virgin fibre. In 2015 the second would cost no more than 160 euros per tonne; while waste paper would set well above 200 euros. Between 2015 and 2016, a series of new investments, and therefore additional capacity, was expected. In China, of course (+350,000 tonnes per year); Belarus (0.4 million tonnes); in the United States (almost one million newly installed capacity); as well as in Brazil, Sweden and, last but not least, Indonesia, thanks to a 2.8 million tonnes new facility.

A time for rationalization

At the Hawkins Wright Symposium in London speakers concluded their overview by recalling that the paper and board production has shown no signs of growth over the last ten years at least; and most of all no signs of a recovery are at sight, especially in the short or medium term. Market pulp demand is, instead, booming, and analysts considered that it is well placed to grow above the trend rate during the next four or five years, «driven by China and heavy global investments in virgin fibre content tissue capacity». At the same time, experts seemed confident that bleached chemical pulp (BCP) supply growth is quite likely to outpace the demand growth, therefore resulting in a further, «renewed period of capacity rationalization». Finally, they predicted that «the burden of displacement will be shared by recycled cellulose fibre or RCF, integrated pulp and high cost market pulp capacity, both mechanical and BCP».

During the same meeting the vice president of International Paper Company, Clay Ellis, focused his speech on fluff pulp, starting with an overview of the pulp market by end use. The big picture he provided showed that in 2014 bleached eucalyptus kraft would represent 38% of global sales; while Northern bleached softwood kraft followed with its 26% share. Fluff would only account for 9% of overall deliveries and Northern bleached hardwood kraft lagged behind with a mere 8% share of the market. As for finished products, Ellis said that tissues and diapers were experiencing the best performances in terms of revenue, thanks to their 4 and 3-4% growth rate respectively. The demand for tissue was growing at the same +3.9% per year rate that the hardwood demand itself displayed, while the vice president of International Paper Company thought that until 2019 the request for paper would grow in China (+2.1%) and worldwide, at a lower rate (+0.1%), declining (-4.1%) in North America.

Fluff’s sustainable success

Clay Ellis pointed out that the request for pulp is constantly rising and 90% of the market is made up of Southern bleached softwood kraft (Sbsk) fluff. The material holds a 9% share of the global market pulp end use market, while printing and writing have a 32% share; tissue, specialty and paperboard account for 29, 19 and 10% respectively. The global estimated output, nearly three years ago, was as high as 5 million tonnes, and all of its industrial applications were on the rise. Forecasts predicted a +4% growth rate for baby diapers; a +4% growth rate both for feminine care and adult incontinence products; finally a three percentage points progress for airlaid and specialty items, until 2019. Especially when it comes to absorbent hygiene products (AHP) a market slowdown is to be considered rather unlikely. Experts considered in fact that within two or three years the related business will rocket, driven by the disposable pro capita income growth in such regions as Middle East and Africa, Asia-Pacific and, most of all, Eastern Europe and Latin America. This makes it mandatory for producers to ensure their production processes the maximum possible level of sustainability, focusing on innovation, quality, services and skilled human resources. EU Ecolabel, Fiber certification and ISO 9001 certification were among the fluff supplier requirements that International Paper Company – which has been heavily investing in the renewal of its North American facilities, in terms of capacity and customer support – recalled.

The US pulp market: a recent overview

Despite a few controversies, the North American pulp market proved to be most lively over the last quarter of 2016 too, as reported by such sources as the US Census Bureau and the United Nations, quoted in the Forest2Market news site by columnist Daniel Stuber. Building upon institutional data, Stuber wrote that last September US exports of total market pulp were on track to flatten in 2016, and therefore expected they would only reach the overall amount of 6.75 million metric tonnes at the end of the year, slightly up from the 6.71 million metric tonnes recorded in 2015. But also well below the record-high results they managed to achieve between 2010 and 2013, as Stuber recalled. Prices were also predicted to be flat, at some 713 US dollars per metric tonne. If on the one hand, early last autumn, «exports of the lesser traded pulp grades» were «declining»; on the other hand, in the same period, «dissolving pulps and the bellwether grade of bleached conifer kraft/fluff pulp» were «driving the increase in total pulp exports». And this was not to be considered «surprising as bleached conifer kraft/fluff» was «on target to be 78% of pulp exports, increasing from 5.0 million metric tonnes in 2015 to 5.272 million metric tonnes in 2016». The bleached conifer kraft/fluff pulp worldwide market was dominated by Canada and the United States (with a 27% and 23% output share respectively); followed by Finland and Sweden (11% each); Chile (9%); the Russian Federation (6%); Germany (3%) and other manufacturing countries (10%). The two top players displayed a respective production of 6 and 5 million tonnes per year, according to 2015 data, while China appeared to be the hungriest consumer due to its 8.6 million metric tonnes rough demand. Therefore, producers are competing in order to increase their market share in the country: «Canada’s exports to China», as Daniel Stuber reported, «appear to be shrinking in 2016 while the United States, Chile, the Russian Federation and the Scandinavian nations are on track to gain roughly 150,000 metric tons each (13-15%)». Further evidences looked even more interesting to Forest2Market: «The fact that the US is increasing export volume is impressive considering the strength of the dollar against other currencies. From a price standpoint», as the specialized digital publication reported, «US exports are on track to be up 10 dollars per metric tonne from 2015’s 644 dollars per metric tonne; while other countries (especially Russia) have been able to offer market pulp at a reduced price compared to the average, due to the exchange rate. We believe this points to steady demand for fluff pulp from the US. The strength of the US dollar and its price point should have eroded export volume, as with other pulps that aren’t traded as heavily. Instead, the opposite has occurred. As our outlook for the dollar is projected to weaken into 2017 (particularly against the Canadian dollar) and as the demand is projected to increase from China by 2-3%, the outlook for US market kraft and fluff producers in 2017 looks positive».

Turkey: a positive outlook

Turkey represents today another crucial market for pulp and paper and the growth of its demand has been already depicted on the pages of Paper Industry World thanks to the contribution of Tugba Erdogan, a representative of Hayat Holding. In the country, the overall consumption of paper and board products has been rising significantly since 2005, when it only amounted to 3,8 million tons roughly. Almost one decade later (in 2014) the figure was as high as 5,8 tons and corrugating materials proved able to gain the largest market share (41%) followed by printing and writing paper (21%) and carton board (17%). The segments of tissue, newsprint, wrapping paper and craft paper only managed to achieve a 8%, 7%, 4% and 2% share respectively, as Erdogan explained. The pulp market has been growing steadily too, in recent years, with forecasts suggesting some 1.2 tons of material could be traded by the end of 2017, as opposite to the 420,000 tons delivered in 2005. Softwood is expected to represent nearly 50% of overall sales although it seems to have lost momentum. In fact, its performance is today considered flat. On the other hand, eucalyptus is still gaining ground and predicted to reach a 700,000 tons volume this year. In 2015 most of the material would address the needs of the tissue industry whose demand was as high as 665,000 tons, 65% of the market. 16% of pulp was destined to hygienic products; and the remaining part to paper and board manufacturers. Eucalyptus is generally imported from such countries as Brazil (55%); Spain and Portugal (38%) and Uruguay (7%); while Turkish producers usually purchase hardwood from Bulgaria (27%); Indonesia (18%); the United States (15%); Finland (11%); Sweden and Russia (7%). The United States are also the country’s main providers of softwood, with a 47% slice of the market, followed by Finland and Sweden with their 18 and 15% respective shares. Germany and Canada are also in the list, accounting for 8 and 7% of overall product sales in Turkey. Eucalyptus represents today 46% of total consumption, according to figures, and the weight of Northern bleached softwood kraft (Nbsk), the paper industry’s benchmark grade of pulp, is 23%. Fluff accounts for a 21% rate and finally hardwood is 10% of the overall request. Tugba Erdogan has stressed the criticalities and challenges that Turkey will have to overcome under the point of view of logistics, but it also has to be noticed that few of the nation’s most important ports are reasonably close to fine paper and tissue mills. This is the case of Izmit, with its six fully operating tissue production facilities, able to ensure a 470,000 tons yearly production. The Izmir area also deserves to be mentioned here, because of the five tissue mills – in addition to two fine paper manufacturing plants – that it hosts. Their overall output could have amounted to some 270,000 tons in 2015.

Sources and thanks to

We really want to thank you the British Wood Pulp Association (Bwpa) & Hawkins Wright Symposium, for the information they give us from London Pulp Week, that took place at the Royal College of Surgeons, last November.

Euler Hermes, Cepi (Confederation of European Paper Industries), Ece-Unece (United Nations Economic Commission for Europe), Assocarta, Forest2Market (blog.forest2market.com), Hawkins Wright.