Central and Eastern European Countries (CCEE) are currently going through a very dynamic phase, with Russia, Poland, Ukraine and Romania, i.e. countries with large populations and a rapidly evolving tissue sector, leading the growth from the front line. This is a geographically huge region, which includes countries that are very different one from the other. The tissue sector in these countries is, at the moment, very fragmented and currently features no leading player, yet it is showing a great capacity to rapidly evolve and lead business from the West to the East.

Let’s talk about tissue and, to this end, let’s start from Italy, which is worldwide famous for tissue production. As everybody knows, tissue production in Italy bears the brunt of the highest electricity bill in Europe and is so competitive that it is indeed exported. And where is this tissue overproduction exported to? This is the question posed by Bodo Kottwitx, BKay Tissue Advice, who spoke last October in Lucca. He assumed that tissue is not only simply exported to Eastern Europe, but that countries like Slovakia, the Czech Republic or Hungary can serve as a possible channel and act as a bridge for the distribution of the goods to even more distant countries. And what is the goods’ final destination? The answer to this question might pave the way for whole new scenarios leading to the identification of niche markets, new opportunities for growth and new areas where tissue has not yet fully entered. Rather than simply pushing to acquire further market shares, tissue companies should identify potential growth areas and niche products. Let us then have a look at the interesting overview of Eastern markets by RISI TIssue Manager Esko Uutela, who has shown, with data at hand, what is happening on Eastern markets.

Eastern European markets

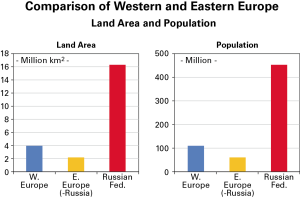

To start with, is it possible to define Eastern Europe? The area we are talking about is very large: as Mr Uutela explains, it comprises 22 countries, including the Caucasian part of Georgia, but not Armenia or Azerbaijan, and not even Turkey in this context. Although it is located in Eastern Europe with over 16 million km2 compared to other Central and Eastern European Countries (CCEE), Russia is a case in itself because it presents completely different conditions than the ones existing in Western and Eastern Europe.

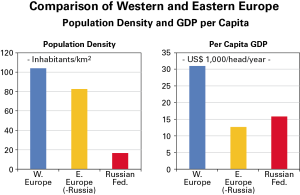

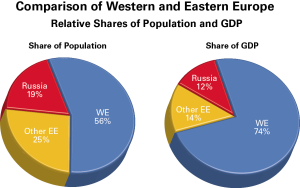

Let us now analyse the population data and economic conditions one needs to consider at a business level. Central and Eastern European Countries (CCEE) have less numerous populations than Western countries, with 100 million inhabitants less compared to Western European Countries, though 400 million people live in Russia, which yet registers a very low population density: this is a major problem, especially if one considers how logistics is influenced by population density, which is very low in this specific instance. Little difference exists between the West and the East, although CCEE countries include large countries like Romania and Ukraine with a lower population density. In terms of purchasing power and the economy, Western Europe registers a higher GDP (30,000 dollars), while GDP in CCEE countries is less than 14,000 and 16,000 in Russia. Looking at production shares in percentage terms, production accounts for 56% in Western countries, 25% in CCEE countries and 19% in Russia, while GDP is divided between the share of Western Europe (74%), Russia (12%) and CCEE countries (14% of the GDP at total European level).

The tissue business: recent developments

Let us then analyse what has happened in the tissue sector in recent years according to Mr. Uutela: imports from CCEE countries has rapidly increased and in 2000 Russia’s import rate was 3% of total tissue consumption, while it increased by 9% in other Eastern countries. Two years later, Russia doubled them reaching a 6% import rate. If this percentage is summed up to the 15% import rate of other CCEE countries, the increase registered totals 21% of European consumption: this figure is still relatively low compared to Western countries, as it equals 1/5 of the total European percentage, yet it is growing and that is the reason why it is of interest.

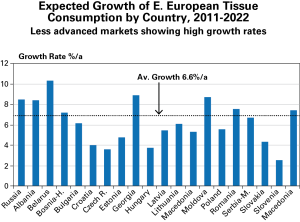

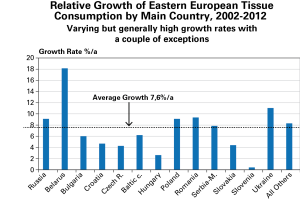

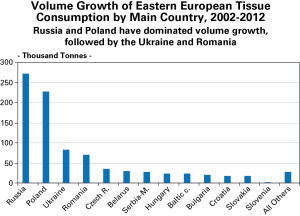

Let us now consider the growth of the tissue market in Europe: while Western countries suffered a decline, CCEE countries registered a good growth, i.e. nearly 10% on a yearly basis and nearly 8% annually in Russia. As regards growth in terms of volume, the Central European market has registered an increase of 2 million tons, while the market of CCEE countries by 600,000 tons and Russia by 250,000 tons. In terms of consumption, Russia is the most important market among Eastern European countries (28%), followed by Poland (23%): these two markets account for more than half of the total market of CCEE countries. If one analyses, instead, recent consumption growth rates in CCEE countries, including Russia, it is worth pointing out that the latest years of economic recession have affected Eastern European countries, too, including Poland and Russia. Furthermore, several variations between the various countries exist: in terms of consumption CCEE countries are quite similar to Western countries, yet consumption in Belarus or Ukraine is rather low, thereby leaving potential room for growth. Looking at European consumption growth in CCEE countries, however, it can be observed that it is exactly Belarus that plays a leading role when it comes to consumption increase, followed by Romania, Ukraine, Poland and finally Slovenia, while there has never been such a pronounced growth for the Hungarian market, which was affected by various problems (picture 5). Conversely, Russia and Poland registered a higher consumption increase in terms of volume, followed by Ukraine and Romania (picture 6).

Private label

As for the «private label» sector, differences from country to country can be registered: in some countries like Slovakia private labels are heavily present, especially as regards both toilet paper and multi-purpose paper towels; the Czech Republic and Slovakia show the same levels as Germany, while they register different levels of toilet paper consumption. Also Poland has registered a growth in the private label sector with an increase from -40 to +60% for toilet paper and from 50 to over 60% for multi-purpose paper towels: this shows that countries are different, yet CCEE countries have experienced similar developments to the ones of Western countries, where the private label sector is growing (except for Hungary, where companies have delocalized their productions). And then there are countries like Russia, where the private label sector is expected to grow but does not currently account for more than 15%: this expected growth will not be quick and will depend on the distribution chain, the supply chain, as well as other factors. Russia is a huge country with well 40 cities with over one million inhabitants and development is not likely to be uniform, with people being truly affected by globalization and others who will continue living in the countryside. Hence, the private label sector is not expected to grow any further.

Demand prospects

But what is it that triggers demand? Several different factors, according to Mr Uutela: population growth, differences in people’s purchasing power, age, population structure, number of people living in urban areas compared to those who live in rural areas, as well as the levels of market penetration of all products, tissue quality development, product specifications, infrastructural conditions that might lead to a given type of targeted development, as well as the distribution chain.

And what can we expect from CCEE countries? CCEE countries (this time including Russia, too) registered a rapid growth between 2001 and 2011. This growth is believed to continue at the same pace, although CCEE countries, too, are expected to register a population decline that will not positively affect consumption.

Prospects and expectations

So, what should we expect against this background? Which CCEE countries show margins for growth?

Data shows that growth in CCEE countries will continue in the next years and also in the next decade. The expected average growth rate will be around 7% annually. The percentage is not decidedly high (6,6%), yet it is consolidated by countries like Russia and Belarus, Georgia, Moldavia, Ukraine and Romania, where a considerable growth rate increase is expected bullet7. In terms of volume growth, Russia is expected to register a very high increase in the near future, with 600,000 tons, followed by Poland, Ukraine and Romania.

As for tissue producers, CCEE countries show a rather fragmented picture: the first 10 companies in the sector make up for no more than 50% of the entire consumption and no company has a leading position in the market. On the whole, change, new projects and new production plants will set the scene. In spite of the expected cutbacks, the market will experience major developments and there will not be considerable reductions in the average capacity of consumption rate.

A rapidly evolving market

By way of conclusion, Central and Eastern European Countries (CCEE) are currently going through a very dynamic phase, with Russia, Poland, Ukraine and Romania, i.e. countries with large populations and a rapidly evolving tissue sector, leading the growth from the front line. This is a very large region from a geographical viewpoint, which includes countries with different profiles, some of which are similar to Western European countries, others to Russia: some countries will be easier to access to, while others will be more difficult to penetrate. Being aware of these differences can help pave the way to lay down the main conditions to do business. The CCEE countries tissue sector is very fragmented and currently not characterized by the presence of a single leading player. Yet, the developments in this sector will largely depend on the investments made available by the presence of those countries willing to act as business leaders. The tissue business is thus shifting from the West to the East in a rapidly evolving scenario, which might look considerably different in just less than a year time.