The UEA price registered at the end of May was 4.98 Euro / t, with a 9 percent increase compared to the last day of April. After over six months indecision on the US commitment on the Paris agreement, President Trump has finally decided to opt out of COP21.

Significant progress has been registered in China as regards the allocation of emission allowances and some progress as regards the planning of the register where the exchange of the emission permits of the Chinese national system will occur. Companies active in the thermoelectric, cement and aluminium sectors have been invited to participate in Ndrc meetings on the allocation of emission allowances, whereby this shows that the national system is likely to involve the three sectors above, to then incorporate the Chinese aviation sector.

Europe

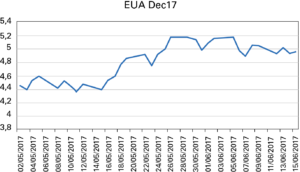

The decreasing trend registered in April was halted only when the EUA reached its lowest price of 4.30 €/t on May 4. The EUA was later on exchanged at prices comprised between 4.30 and 4.70 €/t. The second part of May was characterised by lower auction volumes and a price increase on other energy markets. This contributed to raise the price of emission permits up to a peak of 5.22 €/t. The month closed at 4.98 €/t, thereby registering a 9% increase compared to the previous month.

During the month coal production in Germany increased by 650 MWh compared to April, as reported by the German research institute Fraunhofer SE, thereby contributing to support the price of European emission permits.

As regards the EUA market supply, a total of 91.5 million allowances were auctioned in May compared to the 78.5 million allowances registered in April. Due to a number of bank holidays at the end of April, supply was scarce, and this also contributed to support the price of EUA. The auctioned weekly volumes have gradually been included in the average value from the second half of June and will remain consistent up to the end of July.

The European Commission updated its information on the surplus of allowances currently available on the market, based on which the amount to be included in the Market Stability Reserve from 2019 will be calculated. The Commission believes that the volume of surplus allowances amounts to 1.69 billion allowances.

On the regulatory side, meetings are being held to finish the reform of the 4th phase of the EU-ETS, which is expected to be finalized after the summer, presumably in September / October.

Table 2. Fuel prices. Closing prices for key fuel price contracts on 31 May compared to April closing prices

| Contract | Price | Change |

| EUA Dec-17 | € 4.98/tons (4.57) | 9.0% |

| German power front year | € 30.41/MWh (29.73) | 2.3% |

| Front month Brent crude oil | $ 50.31/bbl (51.73) | -2.7% |

| Summer-ahead NBP gas | 39.90 pence/therm (39,43) | 1.2% |

| Year ahead coal contract | $66.61/tons (66.48) | 0.2% |

North America

After six months of uncertainties on the US stance on the Paris COP21 Agreement, the situation has become clear on June 1, when President Trump announced his intention to opt out of the agreement in line with his electoral campaign promises. Up until the end, US environmentalists had hoped that President Trump and some of his advisers and US companies could still be convinced to maintain the engagements declared with the Obama presidency. The hope vanished after the G7 meeting in Taormina at the end of May, when the President publicly declared that the US will opt out of the Paris agreement and that, at the same time, it will stop contributing to the Green Climate Fund (GCF), as this is believed to be an unjust initiative that is damaging to the American economy.

Despite the international community’s resistance to President Trump’s decision, sanctions are not expected to be imposed on the United States for having quit the agreement. European representatives recognized that China, which is the world’s largest CO2 emitter, will reinforce its position after the US opting out of the agreement and will obtain a political advantage on the international climate change scenario.

The price of allowances on the Rggi market registered an increase in May, reaching 2.67 $/t on the last day of negotiations of the month. However, all traded volumes were subject to a strong reduction from over 12 Mt in April to scarcely 7.7 Mt in May. Market regulators are still negotiating on the future of the Emission Trading Scheme. These negotiations will probably last for several months, with the market being depressed by the feeling of widespread uncertainty that followed Trump’s decision on the market.

China

Works are progressing in China for the setting up of a national trading system. Progress has been made on the definition of an allowance allocation scheme and the finalization of the register where emission permits will be registered.

The National development and reform commission (Ndrc) selected a number of provinces to test the methods of allowance allocations before applying the methodologies on a national scale. As expected, the market will first involve the primary markets of energy production, cement and aluminium, which will likely be followed by aviation at a later stage.

The companies working in these sectors will receive benchmarking allowances. 11 benchmarks have been identified in a range comprised between 0.38 and 1.16 tCo2/MWh for the electrical energy sector based on three technical parameters, i.e. unit capacity, type of fuel and tension. The reference point for the cement sector is 0.85 tCO2 per ton of cement clinker and 9.11 tCO2 per ton of cast aluminium for the aluminium sector.

Last month the National development and reform commission (Ndrc) also finalized the evaluation of proposals for the planning and functioning of the register and the ETS citizen exchange presented by the pilot DRC and Jiangsu. The results of this evaluation are now awaited.

In the meantime, all regional pilot markets have finalized the emission verification and compliance phases for June.

Pilot markets prices and volumes in China.

| Pilot Market | Price May 31 [CNY/Ton] | End-month price change [%] | May allowance traded volume [tons] | May CCER traded volume [tons] | |

| Shenzhen | 32.4 | 2% | 1,228,077 | 1,464,335 | |

| Shanghai | Spot | 35.4 | -7% | 150,820 |

2,381,115 |

| Forward | 38.2 | -8% | 960,000 | ||

| Beijing | 52.8 | 6% | 1,436,031 | 1,572,447 | |

| Guangdong | 14.0 | -4% | 3,124,179 | 1,054,960 | |

| Tianjin | – | – | – | 50,000 | |

| Hubei | 16.7 | 3% | 1,939,292 | – | |

| Chongqing | 3.2 | 122% | 3,030,695 | – | |

| Fujian | 27.4 | -19% | 127,195 | 122,020 | |

| Total | 11,996,289 | 6,644,877 | |||

Source: Thomson Reuters Point Carbon