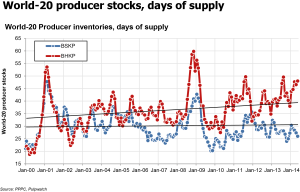

Tom Wright, famous analyst of Hawkins Wright, who spoke at the last meeting of Aiac – the association of agents, traders and local sales offices of the major pulp companies operating in Italy – provided some indicators on the international pulp market. Looking at the stocks of production of long and short fibre held by the world’s top twenty producers, we can see that the markets are very solid on both fibres, Mr Wright declares, and that the stocks are all in the hands of just a few players. Clearly, we should also recall that when looking at statistics, it is important to remember that numbers «do not tell the full story», and account for less than 70% of the short fibre market.

Pulp supplies: where they come from and where they go

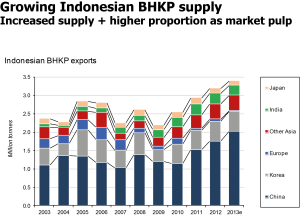

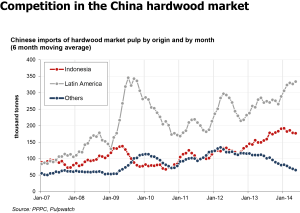

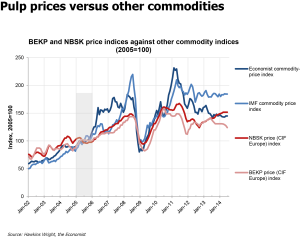

Figure 2 shows the trend of the Indonesian short-fibre pulp (BHKP), explains Mr Wright. In the evolution of exports from Indonesia, we can see the growth of millions and millions of tonnes, after the 2009 decline: a great deal of production comes from Indonesia, as had never been seen before, and is directed towards the Chinese, Korean markets, those of other Asiatic countries, India and Japan. If we instead analyse competition on the Chinese short-fibre pulp market (3), the countries from which imports are brought into China are Latin America – Chile and Uruguay – and Indonesia: all countries that are increasing market shares in China, which gives rise to concern for North America, Canada and the United States, where mixed fibre is produced. This situation also influences prices, and shows that precisely in China, the short fibre is subject to the greatest pressure. In terms of the global economy (4), pulp has never been below the levels of the other sectors like metals, agricultural goods, oil and energy, despite suffering some depression and the slowing of the Chinese economy, and long fibre enjoys better trends than short.

China: production over-capacity?

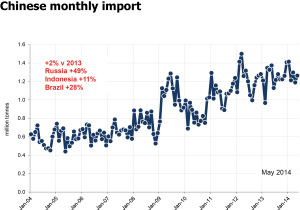

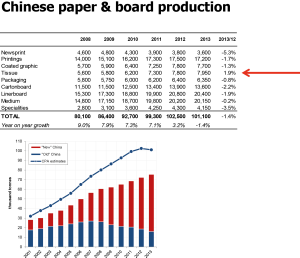

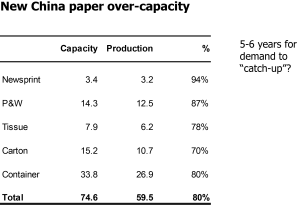

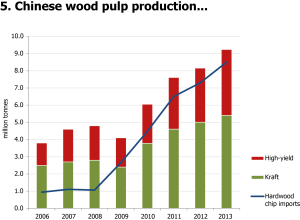

Let’s now take a look at the figures in China. Figure 5 shows monthly imports in China in the last ten years; the upper part of table 6 instead shows the official statistics of the Chinese paper and cardboard industry association: in 2009, growth is reported as 7.9%, in 2010 as 7.3%, in 2011 as 7.1 and then drops to 3.2% in 2012 and to -1.4% in 2013. A decline in paper production is therefore all too clear, yet the figures do not look overly reliable if we compare them with the numerous research studies carried out by Hawkins Wright: below the data given by the Chinese association, we in fact find the Hawkins Wright estimates, which show approximately 75 million tonnes of paper produced last year, as compared with the 101.100 tonnes declared. The Chinese economy is somewhat uncertain, Tom Wright comments, and there are major reviews of their GDP, but it would appear to be increasingly clear that the information they are disseminating does not truly reflect the dimensions of their market: there is therefore a production overcapacity (7), Mr Wright declares, we need to slow investments and if the economy continues to grow by 6-7%, and if we continue to have the same consumption, then we can perhaps hope that supply will equate to demand in five-six years time. In this context, where competition is so intense, deflation has a major impact on pulp and its price.

In China, the demand for imports is very price-sensitive

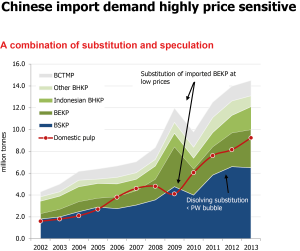

Figure 9 shows the ratio of domestic pulp production (red line), imports and prices. And suggests that in 2009 there was a major economic shock, a stagnation of prices and a reduction of production in China: a combination of replacement of local pulp production and speculation. Today, prices in China are at cost level and – at present – the global pulp and paper market is not growing: there has been great growth in the last 20 years, but as from 2007, this growth has dwindled. And, based on the current situation, Tom Wright specifies, at present we cannot expect to see anything going against this trend, if not a temporary re-development.

In short, therefore, for the next 15-20 years, we will need 100 million tonnes more fibre, the conclusion drawn on the basis of per capita consumption. And even if no growth in paper production has been seen in the last six years, an increase in the pulp market can be forecast: more specifically, an increase of a million tonnes a year. But how is this possible? How can the pulp market grow, whilst the paper market remains stable? Because we are talking about a repositioning of paper production, Tom Wright explains: paper production is a growing industry, not so much in China as in the Middle East and in integrated countries like North America, Japan and Europe: this is the key reason why pulp is set to increase.

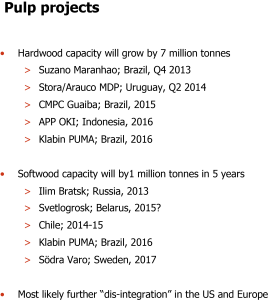

New pulp plants

The production capacity of short-fibre pulp will increase by seven million tonnes over the next three years, whilst production capacity of long-fibre pulp will increase by one million tonnes over the next five years. Over the next few years, therefore, we will need to cope with a load of new supplies, because there have been new projects, never so many in such a short space of time (10): so much investment has been made, in fact, and we will be seeing increasing long fibre capacity that is ever more in line with the growth of demand. For now, actual forecasts cannot be prepared, but the capacity would appear to increase by 1.6 million tonnes per year. What remains unclear is exactly how the market will restructure: some companies will restructure, whilst others may well recycle into other segments and there will probably be some form of consolidation with the market returning to balance.

Forecasts: a new price cycle begins

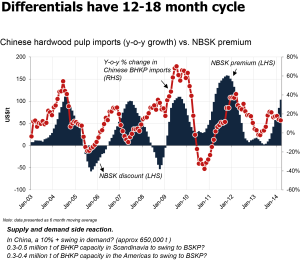

Despite the financial crisis from 2006 to 2012, a range of factors has helped keep pulp levels above normal trends (decline of the sawmill market in North America, import taxes on wood from Russia, prohibition of cutting in Indonesia, advent of bioenergies): all these factors have resulted in a rise in prices, including the earthquake in Chile and the «bubble» of pulp for dissolution. And, at the same time, the American dollar has weakened and China has experienced a boom.

The currency aspect will be the main cause influencing listing, but there is reason to believe that prices will remain below break-even point for a while (i.e. high-cost plants will be operating at a loss): production capacity will increase, whilst China will slow; the sawmill market will improve and the impact of bioenergies will evolve with the Russian fibre supply being easier thanks to the WTO. Will there be better access to fibres for Indonesian pulp plants? Further consolidation will be required, but this will probably take place between low production cost manufacturers.

And, finally, the replacement process will be tested as never before, both by supply and demand.

The interview: focus on eucalyptus

Situation and outlook. When we talk about short fibre, to a certain extent there is a sort of equivalence between eucalyptus and Brazil, the world’s most important supplier of this type of pulp. We interviewed Ari Tapani Borg of Fibria – the global largest producer of eucalyptus pulp – to have a picture of the current situation linked to short fibre.

It is common knowledge that in Brazil, production for export is almost exclusively of short fibre, because there is a greater availability of plantations (there is also long fibre production, further south, which is instead direct towards the local market and integrated market and mainly used for cardboard): therefore 100% eucalyptus, 100% from plantation and 100% certified FSC , PEFC or Cerflor. Eucalyptus is softer than other short fibres and this is why it is widely used both for tissue and a wide range of qualities, including printing paper and writing paper, cardboard and special papers. In Brazil, the life of a eucalyptus tree ranges between 5.5 and 6.5 years and is therefore relatively short, thanks to the favourable climate; however, overall, the quality of Brazilian pulp is the result of 40 years of work.

Apart from Brazil, which other countries are important exporters of short fibre?

«After Brazil, the next most important producer of short fibre is Indonesia, but competition is only in Asia, both for logistical reasons and the lack of certification. Instead, pulp in Brazil is all certified, also in view of the recent Regulation (EU) 995/2010, known as the EU Timber Regulation (EUTR): the tool whereby the European Union intends to prevent the trade of illegal wood in Member States. Moreover, as the pulp derives entirely from plantations, the concept of the chain of custody applies, which FSC certification requires, is very simple, because we know exactly where the wood comes from, and need merely manage the plantations correctly.»

What wood sources are there in Brazil?

«There are three sources of wood: the actual plantation, the major wood producers and small agricultural workers. The major players, such as Suzano, Fibria or Cenibra, are also the owners of the plantations; then there is a part of the wood that is purchased from the major companies managing the plantations, and finally, there are contracts with a great many small agricultural companies (3-4000 thousand), which also have other crops.»

FSC or PEFC?

«Both certifications are widespread. Worldwide, Brazil is the most important producer of FSC certified pulp, even if the demand for PEFC in Europe has now increased and become more well-known in Europe.»

Were there any difficulties in applying the concept of FSC with the farmers?

«Today, this is a problem that we are still trying to solve with FSC. How is the FSC applied in Brazil today? Group certifications are not allowed and for a farmer with just a few hectares, it is very expensive as well as entailing a great deal of effort in terms of bureaucracy and administration.»

To which countries does Brazil export?

«For Fibria, the most important market is Europe, a mature market but in any case the world’s largest. Asia comes in second, China in particular. As concerns North America, Fibria’s market share is more than 90%, which, however, only accounts for 23% of our sales: there, there is a great deal of domestic market of mix hardwood, which integrates provisions. And the use of eucalyptus in the United States is also increasing, but almost always because tissue is rising. Fibria, as a producer, is only present in Brazil, because it owns the plantations and factories; instead, as a seller, it operates in Europe, Asia and the United States of America.»

And what can you tell us about China?

«It is very difficult indeed to know exactly what is happening in China. One thing is certain: the market is growing strongly and, secondly, there are major over-capacities, because they have invested a great deal. Thus prices are low, but not because there is no demand, rather because the supply is too great.»

What problems emerge with respect to the world pulp market?

«There is currently too much capacity that is entering the market and closing it. And there are various different pulp production companies that will be forced to close because there is too much production capacity, whereas only those with lower costs will survive. In terms of demand, this means that there is insufficient demand to account for all the new production capacity. Moreover, we cannot consider doubling consumption worldwide: if China grew 10% five years ago and now grows 7%, the value of 10% is smaller than today’s 7%, even if it is a lower percentage. In Europe, growth is far less, because we already have very high paper consumption levels and we cannot increase paper consumption infinitely. Tissue paper in Europe is at very high levels and cannot be doubled. Turkey is instead an interesting market: it has a young population and a growing market; Egypt was growing before it began experiencing its current problems, as were Vietnam, Syria before the civil war, North Africa, Morocco and Tunisia. In Turkey, tissue production has doubled in the last two years, reaching 400 thousand tonnes, and is set to increase further. And it will become a basis for production for all surrounding countries, because it enjoys greater political stability.»

Overcapacity, demand and price. What is the connection?

«Figure 11 shows the increase in capacity, which, however, cannot be the only explanation for the price increases. Here, for example, we see the great crisis of the years 2009-2010 (the price is given in orange and the new plants in green). Instead, in the years 2004 to 2007, there were increasing new plants and the price increased constantly because the economy was growing. Then there was a decline in the price due to the financial crisis, and it was precisely amidst this crisis that investments began, whilst the price rose because there was an economic recovery. In other words, the greater the recovery, the more the price increases, because demand produces further demand and when demand increases, investments are made in pulp plants, which, however, will only become operative at least two years down the line. This is how increased capacity can be explained at times that would not appear to be appropriate.»

What do you expect?

«If we are talking about printing paper, as we can see from figure 12, the world peak was reached in 2007, with 117 million tonnes, whilst forecasts suggest that in 2016, we will be at 114 million. If we take a look at the last few years, the loss of the use of writing paper on mature markets is offset by the increase in writing paper on other markets: today, the emerging markets are larger than the mature market, and pulp consumption worldwide is rising and essentially derives from tissue and some packaging. The largest reduction in demand for printing and writing paper has been in the United States of America, which is an entirely integrated market, whilst the greatest growth has been seen in Asia, which – apart from Indonesia – is entirely non-integrated.»

Any forecasts?

«As concerns short fibre, a 2.8% increase is expected from the annual level, and for long fibre, this should instead by 0.7%. Which does not mean that it will grow less, because the total value is greater.»

About Fibria

Fibria is the global largest producer of eucalyptus pulp. The company has an annual production capacity of 5.3 million tons, with mills located in Três Lagoas (Mato Grosso do Sul), Aracruz (Espírito Santo), Jacareí (São Paulo), besides Veracel, a mill in Eunápolis (Bahia), in joint venture with Stora Enso. In partnership with Cenibra, it operates Portocel, in Aracruz, the only Brazilian port specialized in pulp shipments.

With its operations based entirely on renewable forest plantations, in the states of São Paulo, Minas Gerais, Rio de Janeiro, Espírito Santo, Mato Grosso do Sul and Bahia, Fibria has a total forest base covering 968 thousand hectares, of which 343 thousand hectares are native forests that have been set aside for environmental conservation. In October 2012, the company entered into a strategic alliance with the Canadian company Ensyn to invest in renewable fuels derived from wood and biomass.

Dear sir,

Have a good day,

This is regarding for our request we are one of the tissue company in sri Lanka my MD plane go for the new jumbo roll , row material company we very happy to do the business with you we need about jumbo roll price.

Thank you&best regards,

Mahesh.S

Good morning, which jumbo roll you mean?

Dear Sir/madame

We are Transpaper Ltd.. We are East Africa’s leading Stationery supplier

We are very much established, credible and big supplier of various

goods in East Africa.

We supply various countries We would like to buy your product in large

quantity.

All types of Copy Papers and paper related products.

we want to start business relationship with a credible company to

expand our distribution capacity.

Hence the reason to source for credible and dependable long term suppliers.

Please forward us your parking list and quotations

Kindly get back to me as soon as possible

Thanks & Regards,

procurement manager

Praise Okirya

Transpaper Ltd.

23 Nkrumah Road Kampala

24564, Uganda.

Tel: +256 704408753

Fax: +256- 413281698

Email: transpaperlimited@gmail.com

What do you think the pulp industry in the US will trend in 2017?

Comments are closed.