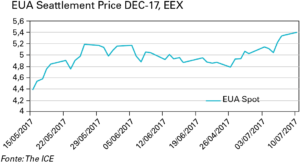

June is a relatively calm month for the EU ETS market, with the EUA contract below 5 €/t almost for the entire month, thereby halting the increasing trend registered last May. In its decreasing trend the price reached its lowest record at 4.78 €/t on 26th June, to then revert the trend at the end of the month and close at 5.03 €/t under the pressure of the price trend of other energy commodities. In the first week of July the EUA continued its climbing route, earning over 6% and reaching 5.34 €/t on 7th July and 5.50 €/t on 10th July. If the June increases had been caused by the trend of the energy market, the increase registered on the first days of July have to be ascribed to the expectations related to the meeting of 10th July between the European Parliament and the Council in the trilogue.

The meeting of 27th June marked a very important step forward in the European negotiations between the European Parliament, the Council and the Commission on the reform of the ETS market. The trilogue between the European Council, the Parliament and the Commission was the occasion to approve the results of the previous three technical meetings held between April and June. The following meeting of the 10th July ended with no final agreement. Yet the draft reference document of the reform is defined on some important issues. The parties confirmed their positions on issues, like protection against the risk of carbon leakage the financing possibilities of the ETS system through proper funds.

The reform approval process goes on, although slowly, however it is difficult to expect major new developments on a possible agreement before the end of September.

In general, from a political viewpoint June was marked by the UK and France elections, but their results have had no significant repercussions on the CO2 market.

Table 3. EUA Dec17 Volumes/Seattlement Prices Data

Open in June (€) 5,08

High in June (€) 5,17

Low in June (€) 4,78

Close in June (€) 5,03

Change May/June closgin price (%) 1,00

Monthly volume traded in June (Mt Co2e) 272

Change May/June monthly volume (%) -9,60

Fonte: Thomson Reuters

North America

The Californian carbon market favourably welcomed a clarification that had been long needed by the end of June. The Supreme Court rejected the appeal put forward by the Californian Chambers of Commerce, challenging the legality of the state carbon trading, which was considered to be an illegal tax. The Court decision ended the uncertainty that had for years questioned the possibility for the ETS system to continue, since the norms in force are valid only until 2020. Although this legal risk has been avoided, the details of the new national ETS system still have to be defined.

Governor Jerry Browne put forward a new proposal, which embodies the compromise reached with the representatives of the national oil industry.

In the meantime, the price of CCAs (Californian Allowances) has earned over 50 cents in June, to close at 14.79 $/t.

The price of allowances on the Rggi market increased, as well, though this cannot be ascribed to a specific reason that can justify the increase. The reference contract of Rggas allowances expiring in December 2017 earned 85 cents in June, thereby registering an increase of over 30%. The volume exchanged in June went down to 4 million tons compared to the 7 million tons exchanged in May. As regards the norms, the revision of the ETS system has only just begun. Stakeholders met at the end of June to submit a number of possible solutions for evaluation.

Another Ontario auction subscribed

For the second time, the Ontario auction of allowances was entirely subscribed with a bid to cover ratio of 1.22 and over 25 million allowances sold at 18.72 $/t. In spite of the success achieved, the ration is still below the average of 2-3 that is normally registered in European auctions.

The Ontario secondary market registered a reduction in the volumes exchanged in June of 700,000 allowances. The market closed the month with a price of 19.26 $/t. Ontario intends to enter the WCI (Western Climate Initiative) market starting from next year. In mid-July, the Canadian government announced the introduction of a low-carbon fund of 2 billion dollars, which will contribute to reach the objective of reducing emissions. The fund will support the Canadian emission reduction projects. Financing will be available only for the provinces that will decide to join the initiative.

China’s position after us exit from Paris agreement

After the US announcement to withdraw from the Paris agreement last month, China is expected to continue its efforts and to cooperate with the other countries in the fight against climate change.

Soon after Trump’s announcement, the Chinese President Xie met Californian governor Jerry Brown to discuss climate issues in Beijing. On the occasion of the EU-China summit in Berlin China confirmed again its intention to collaborate with the EU to comply with the Paris agreement even without the United States.

The director of the PRC’s National Development and Reform Committee (Ndrc) Xie Ji has underlined that the primary role of the national ETS market will be to support the country in reducing emissions, and not so much in favouring market speculations. Xie confirmed that the national scheme will be launched by the end of the year, yet he did not provide additional details on the matter. His observations show a cautious behaviour, which aims at favouring market stability rather than market liquidity.

Most regional pilot markets have completed compliance during the month of June. To facilitate the return of allowances, some of the 7 pilot markets, e.g. Beijing and Guangdong, allowed the exchange of emission permits also on Saturdays and Sundays. Other markets, e.g. the Shanghai pilot market, auctioned additional volumes of allowances.

Korea

At the beginning of June, South Korea shut down its old nuclear plant in Kori, which had started its activity in 1978. The newly-elected President Moon Jae-in announced that the country will focus on nuclear energy, thereby eliminating old plants to build new-generation nuclear power plants. The President also affirmed his commitment to shut down 10 coal-fired electric power stations older than 30 years by the end of his mandate in May 2022. The objective is to considerably reduce the air pollution generated by the national industrial sector. The price of the Korean ETS emission permits was 21.500 KRW (equal to about 17.3 €/t) at the end of the month. Korean offsets (KCU16) closed at 20.800 KRW/t, with about 140,000 units negotiated during the month.