In 2017, the benchmark carbon contract gained more than 20%. The EUA Phase 3 daily futures closed at 8.14 euro, while the Dec18 contract settled at 8.18 euro. By doing so, the EUAs disappointed those market participants who expected the price to fall further in the first year when the auction volumes were not reduced by back-loading (daily auction volumes increased by 600,000 compared to 2016.) In 2017, the price of allowances cancelled almost all the losses it suffered in 2016 when it fell from 8.53 euro (settlement at the end of 2015) to 6.61 euro in December 2016.

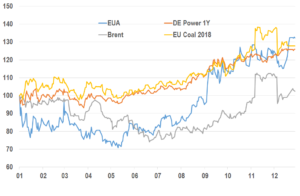

The carbon market received strong support from fundamentals in the energy mix. The German front year power, a European benchmark gained 25.9% and closed the year next to its yearly maximum. Power prices were boosted by a stronger economy, higher coal and gas prices and lower availability of French nuclear capacities. The EUA price underperformed other commodities in the first half of the year, but the trend changed in summer and by September, the carbon market caught up with power and coal.

Political reforms also had a positive effect on the price of allowances. In 2017, lawmakers accelerated the approval process of the EU ETS reforms for the post-2020 period. There seemed to be a broad agreement among politicians about the ambition of the reforms. As a consequence, the three main institutions (Commission, Parliament and Council) reached a consensus by the end of the year and adopted a reform package in November that is – in many aspects – more ambitious than the original proposal of the European Commission from 2015.

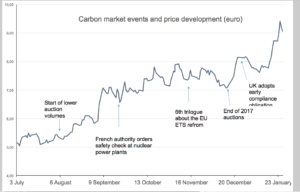

As a reminder, we selected the most important carbon market events from each month last year:

January 2017 – The year started in a negative mood for the allowances as in the first month the EUA lost 18.5%. Traders were afraid that the increased auction volume would not be met by enough demand. In addition, the Commission proposed the extension of the stop the clock measure for international airlines, denting hopes that newly included aircraft operators would absorb the surplus of allowances.

February 2017 – The Commission welcomed the European Parliament adopting the reform package affecting the EU ETS after 2020. The Parliament’s position was more ambitious than the Commission’s proposal as it contains also the reform of the market stability reserve.

March 2017 – In a historical step, the UK submitted Article 50 which opened the separation process of the UK from the rest of the EU. Among the many questions Brexit raised one was about the countries EU ETS membership after 2019.

April 2017 – After adopting a fragile consensus among member states, the trilogue about the post-2020 reforms started between the Council and the Parliament with the Commission coaching the negotiations.

May 2017 – 12 May the European Commission published its first surplus indicator. According to its calculations, the total number of allowances in circulation was 1.69 million in the EU ETS. This indicator will be the basis of the calculation about how many allowances have to be deposited in the market stability reserve from 2019.

June 2017 – To see her position confirmed by the public, British PM Theresa May called general elections, but the result was rather disappointing for her as her conservatives were not able to secure majority. June marked a historical moment also in international climate negotiations: US President Donald Trump announced his country’s withdrawal from the Paris Climate Accord.

July 2017 – Until July a total of 139.9 million allowances have been distributed from the phase 3 reserve. Out of these 25.8 million have been allocated since January 2017, meaning that some 70% of the new entrants reserve was still available.

August 2017 – In August all traders (or at least those who are not on holidays) watch market reaction on the reduced auction supply. Last year was no exemption, although the month started with a strange auction result that cleared with a premium of more than 30 cents to the secondary market price. At that time, it seemed a huge mistake to purchase allowances at 5.60 euro, but prices above 8 euro in December put the auction result in a different light.

September 2017 – After the UK in June, another disappointing general election took place in Germany. Chancellor Merkel’s party did not receive enough votes to form a government and coalition talks with other parties did not bring any result until now (more than 100 days passed since the elections already).

October 2017 – In the last three months of the year the auctions of aviation allowances (EUAAs) resumed to cover the needs of those aircraft operators that remained covered by the EU ETS after the extension of the Stop the clock. The auctions met healthy appetite and were three times oversubscribed.

November 2017 – After several rounds of trilogue negotiations, the Council and the European Parliament agreed on the final design of the post-2020 reforms.

December 2017 – In order to protect the eligibility of its allowances in the EU ETS, the UK adopted an amendment to the current legislation, bringing forward the deadlines for its installation to report the 2018 verified emissions and to surrender the equivalent amount of allowances before the effective Brexit date (19 March 2019).

Carbon market broke last three year’s pattern in 2018

Although in 2015, 2016 and 2017 the EUAs lost 3.3%, 26.6% and 18.5%, respectively, the carbon market had a surprisingly strong start to 2018.

The price of allowances increased by 8.2% in December 2017 and considering this rally and the seasonality chart, traders turned more cautious in the first days of January. The market seemed to confirm market expectations in the first days of the year, but from mid-January the price turned sharply higher to hit a 6-year high at 9.56 euro on 24 January.

Energy fundamentals did definitely not support this rally. Temperatures around Europe remained above the seasonal average and kept the power prices under pressure. The safety checks of the French nuclear reactors did not have such a huge impact on the power supply than last year. High coal prices coupled with the increasing carbon prices deteriorated the profitability of coal fired power plants and pushed the German dark spread (a European benchmark) into negative territory.

The most important factor supporting the carbon market these days are the adopted reforms starting with the market stability reserve, which removes 24% of the surplus allowances from next year already, tightening the supply side of the carbon market.

In addition, many industrial installations that used their surplus accumulated in the period of the financial crisis turn short these years and have to purchase allowances in the market. Their demand represents a stable support for the price.

When the EUA prices started increasing in mid-January 2018, those traders who expected the price to fall and opened therefore short positions, saw themselves forced to close their positions to avoid more losses. With their purchases they contributed to the rally.

As the new MiFID II regulation became binding from 3 January 2018, market saw old market participants returning to the carbon trading (Morgan Stanley, Marex Spectron etc.), because it was easy or them to enter with most of the administrative burden absolved already for MiFID I while many carbon market participants still struggled with understanding their obligations. These new market participants might have started opening new positions in the market as well.

Last, but not least the fact that the British installations will have a compliance obligation within the EU ETS also in spring 2019 keeps them as buyers in the market.

All in all, although the rally of the second half of January seems to be overdone, there are reasons to believe that the EUA price remains in the increasing trend channel in the coming period.