How is the cellulose market going in the world? Here is a forecast of the supply, demand and prices over five years, and the long-term trends.

The international cellulose market is very complex, particularly if we consider that it depends on various factors: global economy obviously, but not only that, also politics, new technologies and their impact on our habits, China and the growth of emerging countries like Turkey, Vietnam and Indonesia. Brian McClay, from Brian McClay & Associates Inc., attending the annual meeting of Aiac (Associazione Italiana Agenti Cellulosa) [Italian Association of Cellulose Agents], speaks of it as an interesting and dynamic sector. If we want to take a «photograph» of the current moment (on the data available), one aspect to consider first of all is that the demand for cellulose continues to grow by 2.7% a year and is gaining market share. In 2013, and also in 2014 – explains McClay – it accounted for 16% of all fibre, with a 2% growth on 2003. If we look at graph 1, on the right, we can see some information on the cellulose sector: 60 million tonnes in 2014, 6 million tonnes dissolving pulp, 40 billion US dollars in the year and 90% of exports, 60% of which must cross the ocean to reach their destination. But the factors which influence the dynamics of the cellulose market are varied. Let’s quickly look at what they are.

The structure, the currencies, the climate, the trend of the paper market

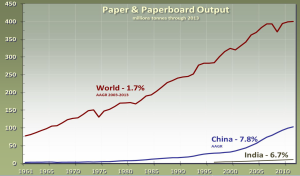

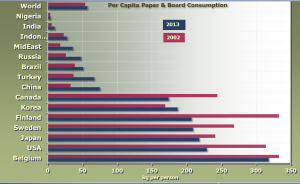

Let’s look at its composition: cellulose is a fragmented sector, in as much as the ten main manufacturers represent less than 40%. For the most part, prices are given in US dollars, and of course we know how currencies have a great effect on who «loses» and who «wins». Third aspect – says McClay – it is a sector driven by supply stocks which also depend on climatic factors and are linked to the environment: 20% of the world’s cellulose resources are in areas subject to significant earthquakes – like Indonesia or China – or where there is drought – like in China itself, Brazil, North and South America, climatic events which, however, have a considerable effect on the supply of cellulose to international markets. And finally, a strategic factor is the trend of the paper market (graph 2), which is still growing if one thinks of the sectors for packaging paper, special papers and tissue: in the last ten years the annual growth of paper and cardboard was 1.7% and it is forecast to reach 1.8%. Also taking into account, finally, the value of recycled cellulose, thanks to the effort linked to the recovery of paper, graphics and packaging, which enables it to be recycled.

China and more besides

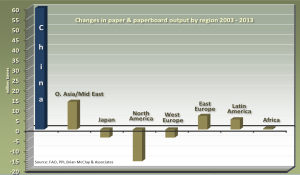

But where is all the attention concentrated? Let us start with a giant, China. Graph 3 is very clear, explains McClay: the blue column indicates the increase in net production of paper and cardboard in the last ten years in China: now we are speaking of 65 million tonnes of paper and cardboard, almost all non-integrated cellulose. The cellulose market in China is very complex and difficult to analyse. Small purchasers look at large purchasers of cellulose before buying, and there is a strong presence of intermediaries.

But it is not only China, but also other Middle Eastern countries: Turkey, for example, which has become a million tonne market, and there are other «small Turkeys», like Vietnam or Indonesia, which have similar characteristics and are clearly growing.

If we are talking of paper, China is a big player in the market, since it has a growth rate of almost 8%, or 26% of the total of paper and cardboard. And then India emerges from amongst the important names. India is similar, even if different, younger, and within 20 years will be the next world giant for paper usage: it does not have large resources, it does not have cellulose and wood supplies, but it imports wood chips, cellulose and waste paper, and has a lot of growth space, particularly with regard to tissue. To give just one example, Italy, with its 61 million people, uses ten times as much toilet paper as the 1.3 billion inhabitants of China. And faced with these clear changes before us, we participate in what is happening, on the other hand, to the developed economies, like Japan or North America, where paper and cardboard manufacture has reduced but will continue.

The economic forecasts

What can we predict, therefore, for the future? First of all, a 4% growth in GDP (Gross Domestic Product) is estimated in the next five years, against 3.4% in 2013-2014, and a growth in China of 7% a year: data which gives a great boost, in particular, to the property sector. The people who could make the difference are the US consumers who have money, are confident, have less debt, want to buy and will drive the economy, particularly next year. On the other hand, the Eurozone recovery is slow, but it is a large economy and experts are confident that there will be growth. One needs to also take into account that next year there will be elections in the United States: a fact which usually stimulates paper consumption, since there is an increase in newspapers, periodicals, magazines: everyone is interested in the elections and things will improve also because of this. Just as happened for the Olympic Games, which did not bring about radical changes but clear improvements. 2016 will therefore be a watershed year, and it will be a good year as regards the economy.

Medium and long-term forecasts in the pulp&paper sector

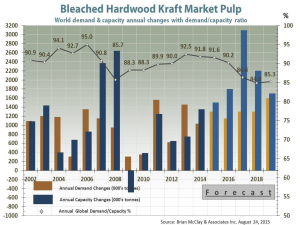

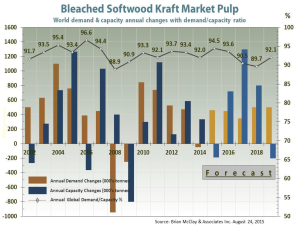

Experts are very cautious in making forecasts, since no-one knows the specific prospects, but one can only make suppositions. Between now and 2019 cellulose should grow by 2.7% a year (BSK 1,8%, BHK 4,1%), the worldwide manufacture of tissue should grow by 4% a year, special papers by 2% and for cartons (folding boxboard) the estimate is +3% a year. And, in conclusion, the worldwide demand for cellulose each year is estimated at 1.6 million tonnes.

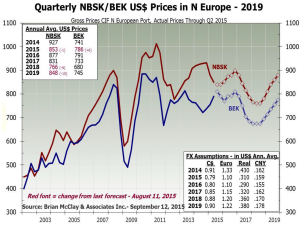

Between 2016 and 2018 there will be 7.1 million tonnes of capacity for BHK and 2.8 million tonnes of BSK, with a capacity much higher than demand. If all this data is gathered onto one single graph (4), the blue line is the capacity and the yellow line the demand: a situation which is envisaged to be very hard in 2017 and 2018 for sellers. And the prices, therefore, do not surprise us: between 2017 and 2018 it will be easier to see spot purchases rather than ones linked to contracts (graph 5).

In a partially uncertain framework, however, what – on the other hand – appears certain is that despite the modest Average Annual Grow Rate (AAGR) of 4.6%, the output levels of China will reach 180 million tonnes in 2023. But not only China, also India, Russia or Brazil are places which use cellulose, and also have high scope for improvement, if we consider the per capita consumption per base/kg (graph 6).

A few more optimistic conclusions

Faced with cellulose market performances and factors which are not really under our control, there are some aspects which it is good to bear in mind, Brian McClay reassures us. If we think of writing paper, it is true that the consumption of newspapers peaked at the end of the 1980s and then started to decline, but there are still growth margins. For example, fashion magazines will not have a boom, but they continue to be stable and have a future, both glossy and non-glossy. A note of «colour»: when Caitlyn Jenner «came out», she did not choose social media, but the well-known magazine Vanity Fair. There are, indeed, interesting aspects which show how the perception of communication channels continues to evolve, as is shown by the blocking of online advertising which is increasingly requested by Web users, in favour of paper communication channels. Reasons why the experts are expecting a higher demand. And to conclude, tissue: countries like India, by becoming more urban, will boost consumption, will increase hygiene awareness and people will become more demanding. The same World Health Organisation confirms, indeed, that hand hygiene goes right through from washing with water and soap to using a paper towel to dry them. The world needs these changes and tissue paper is part of them.